You are here

BVI FSC Newsletter: June 2022

The BVI Financial Services Commission's New Authorisation and Supervision Division Becomes Fully Operational, July 01 2022

The British Virgin Islands Financial Services Commission (the "Commission") advises all industry practitioners that its new Authorisation and Supervision Division becomes fully operational effective Friday, July 01 2022.

The new structure transitions the Commission's supervisory framework from product-based supervision to risk-based functional management, allowing the Commission to more efficiently enhance oversight of regulated businesses and individuals and reduce potential harm to consumers and markets.

The Authorisation and Supervision Division comprises the following four (4) new units, which now replace the traditional Investment Business, Insurance, and Banking, Insolvency and Fiduciary Services divisions:

- Authorisation

- Prudential Supervision

- Specialised Supervision and

- Market Conduct Supervision

Authorisation

The Authorisation Unit is the centralised Unit responsible for authorisation and cessation activities of all regulated entities, products and persons and receives and processes all pre-licensing and post-licensing applications for approval. The Unit's function is to ensure that all applicants and existing regulated entities satisfy the requirements to carry out regulated activities. Submission of all transactions requiring approval should be sent to this Unit.

Prudential Supervision

The Prudential Supervision Unit will use a risk-based approach to operate as a pooled supervisory unit. This Unit is responsible for monitoring and supervising regulated entities and persons that present a lower level of risk, and reviewing and processing all post-licensing filings required to be submitted by existing regulated persons.

Specialised Supervision

The Specialised Supervision Unit's function is to monitor and supervise regulated entities and persons with a higher level of risk and systemically important financial institutions. This Unit will be responsible for undertaking proactive and enhanced supervision of these entities. The Commission will directly inform any entity that falls within the supervisory remit of this Unit. Any entity not receiving the Commission's notification will be subject to supervision by the Prudential Supervision Unit.

Market Conduct Supervision

The Market Conduct Supervision Unit's function is to promote a fair and transparent market in which all stakeholders within the financial services industry are treated fairly, honestly, and professionally. This Unit is responsible for implementing consumer protection measures and exercising the Commission's powers in relation to protection against discrimination, consumers' right to be informed, consumers' right to a defined or definable contractual obligation and protection of rights and interests of consumers of financial services generally.

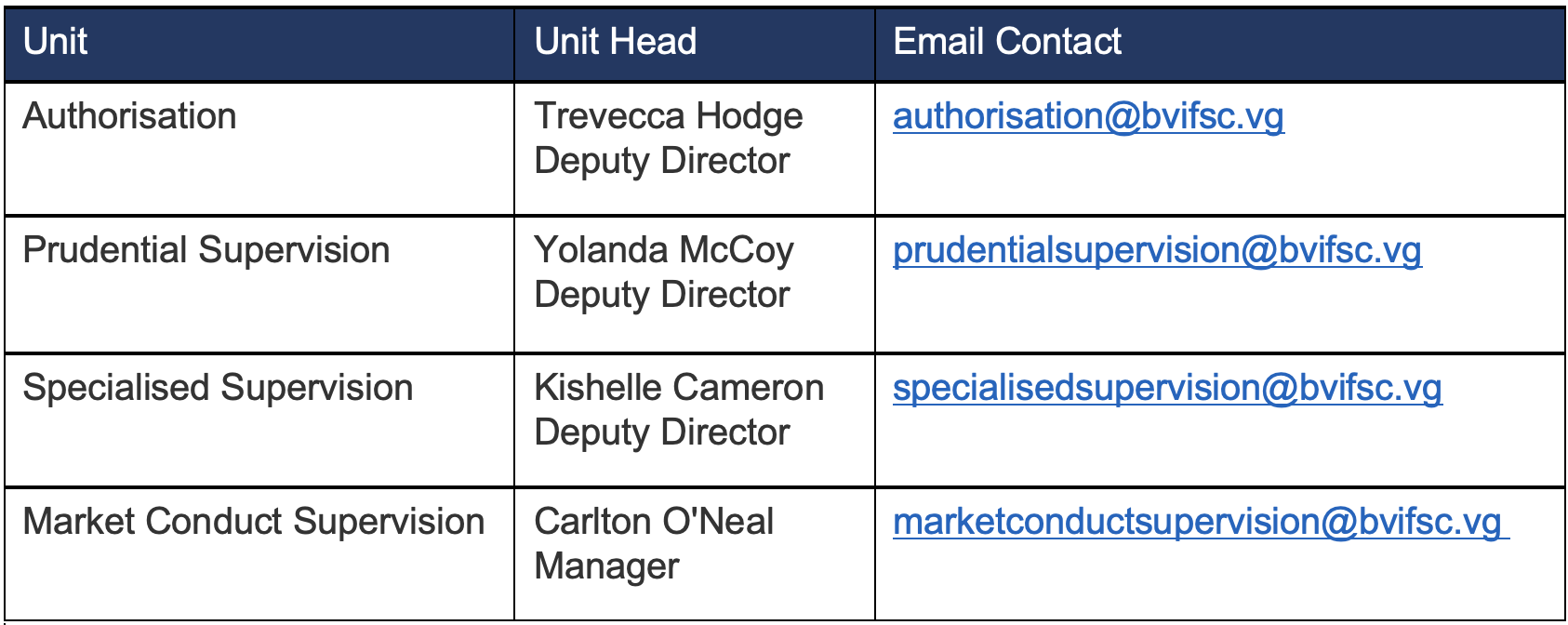

Effective July 01, 2022, the Commission advises the public that submissions to the Authorisation and Supervision Division should be made to the respective Units as detailed below:

Under this new operating structure, the Commission is committed to:

- reducing redundancy and enhancing transparency in the regulatory reporting process;

- ensuring our requirements can respond effectively to innovation and other significant developments in the financial services industry; and

- improving on the Commission’s customer-focused priorities by streamlining its processes, improving response times, and continually strengthening the scope and efficiency of the service provided.

Mr. Glenford Malone, Deputy Managing Director, Regulation, is the Commission's Chief Regulatory Officer responsible for supervising the Authorisation and Supervision Division and implementing the Commission's overall regulatory strategy.

Please continue to monitor the Commission’s website for essential updates and details concerning new supervisory and other operating structures. The Commission looks forward to serving you better.

Glenford Malone Appointed Deputy Managing Director, Regulation – Effective January 01 2022

The Commission confirms the appointment of Mr. Glenford Malone as Deputy Managing Director (the "DMD"), Regulation with effect from January 01 2022.

Mr. Malone has over twenty years of experience within the regulatory environment, having worked as Assistant Registrar of Mutual Funds for the Financial Services Department before joining the Commission in 2002 as a Senior Regulator. He was promoted to Deputy Director, Investment Business in 2006 and then Director, Investment Business in 2017. His most recent appointment was as Acting Deputy Managing Director, Regulations which took effect on February 15 2021.

Mr. Malone is a Certified Anti-Money Laundering Specialist and a trained Financial Examiner and plays a significant role in the AML/CFT Regime of the BVI, where he is responsible for guiding the Commission, Government, and all relevant stakeholders.

Mr. Malone has also served as the principal liaison to and represented the Commission before global organisations such as the International Organization of Securities Commissions (IOSCO), Caribbean Financial Action Task Force (CFATF), the International Monetary Fund, the Organisation for Economic Cooperation and Development (OECD) and the World Bank.

Mr. Malone holds a Master of Laws degree in Law and Finance and a Bachelor of Business Administration (Economics and International Business).

The Board and Managing Director are excited to have Mr. Malone lead the Regulatory Affairs of the Commission and look forward to his continued commitment to building more robust financial services products for the Virgin Islands.

REGISTRY'S CORNER

This month, we highlight the BVI Business Companies Act, 2004 Part IV of Schedule 2 of the Transitional Provisions.

TRANSITIONAL PROVISIONS: PART IV AND PART VI of SCHEDULE 2

All companies incorporated under the International Business Companies Act (1984) (the "IBC Act") and the Companies Act (Cap 284) (Local Companies) that were on the register at the end of the transitional period and did not voluntarily elect to be re-registered under the BVI Business Companies Act, 2004 ("BC Act") during the transitional period, were automatically re-registered on January 01, 2007, and January 01, 2009, consecutively.

To avoid inconsistencies between the requirements of the BC Act and terms to be included in the Memorandum of association of each of these company types, specific provisions were introduced by the Transitional Provisions to the BC Act (Transitional Provisions Parts IV and VI of Schedule 2).

Although IBCs were required to have a registered agent, local companies were not. As a result, the appointment of a registered agent must be filed before a local company files an application to disapply Part VI of the Transitional Provisions. The registered agent information should be stated in the Memorandum as the first Registered Agent of the company.

The Commission's Registry of Corporate Affairs will continue highlighting BVI Business Companies Act legislation and other information in future publications.

Public Statements

Under Section 37A of the Financial Services Commission Act (Revised 2020), the Commission considers it necessary to issue Public Statements to protect the customers, creditors, or persons who may have been solicited to conduct business with purported financial services entities.

The public is advised to exercise caution when conducting business with the following persons: