You are here

Money Services Transaction Levy Payment Guidance

British Virgin Islands Financial Services Commission

MONEY SERVICES TRANSACTION LEVY PAYMENT GUIDANCE

Any licensee holding a Class A licence pursuant to the Financing and Money Services Act, 2009 is required to collect from its customers, a 7% transaction levy on the amount of funds being remitted outside of the Virgin Islands, per transaction. Class A licensees are required to pay the collected transaction levy to the Commission on a quarterly basis.

Payment of Transaction Levy to the Commission

Due Date

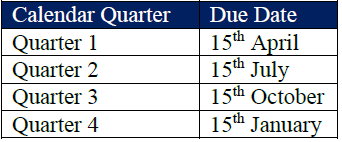

Payment of transaction levy is due to the Commission within 15 days after the end of each calendar quarter (as detailed below):

Accompanying Documentation

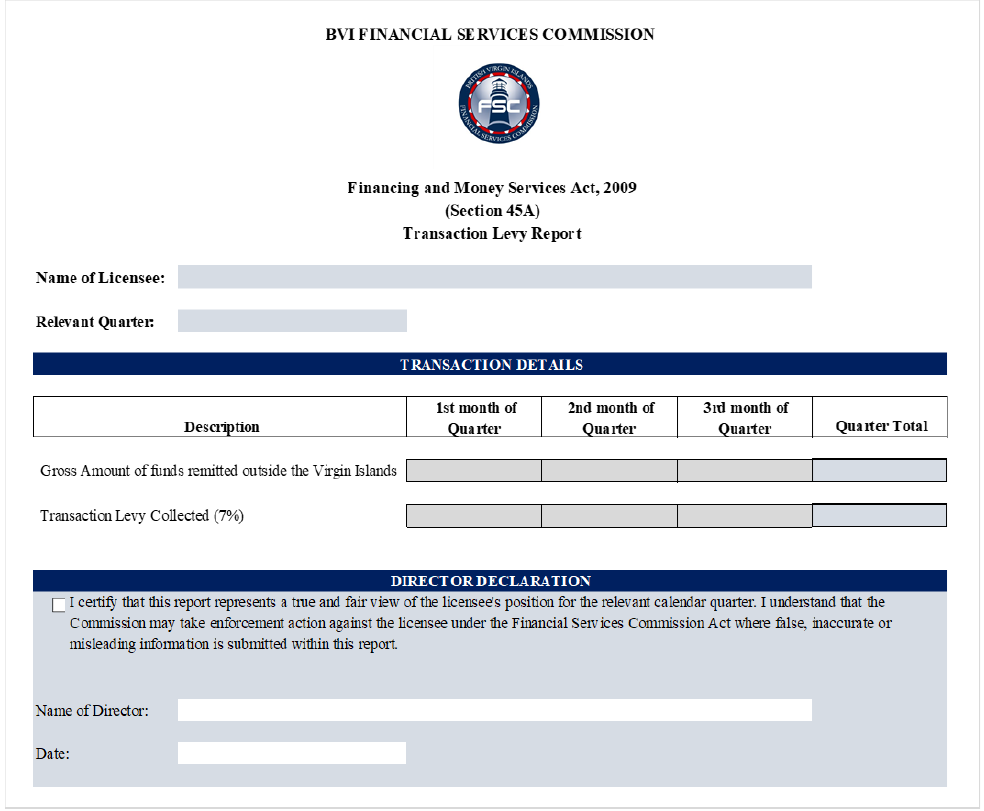

Payment of the transaction levy must be accompanied by the transaction levy report (Form FMS-1), detailing:

- the value of funds remitted outside the Virgin Islands for each month of the relevant quarter being reported on:

- the transaction levy collected for each month of the relevant quarter being reported on; and

- the total value of funds remitted outside of the Virgin Islands and the total transaction levy collected for the relevant quarter.

Corresponding Reports

Remittance amounts submitted within the transaction levy reports must correspond with the remittance amounts outside the Virgin Islands, within the licensee’s quarterly prudential report.*

*This does not apply to the transaction levy report for Quarter 2, 2020, which should only consider remittance amounts for May and June 2020.

Upcoming Events