You are here

BVI FSC Newsletter: June 2023

The Virgin Islands 2022 Money Laundering Risk Assessment: July Outreach Webinar Planned

On 9 June 2023, the British Virgin Islands Financial Services Commission (the ‘Commission’), in conjunction with the Financial Investigation Agency (FIA), published the Virgin Islands Money Laundering Risk Assessment 2022.

In accordance with the National AML/CFT Policy and Strategy, the Territory has committed to periodically updating its various risk assessments based on intelligence gathering of potential or developing risks. Given the ongoing shifts in the global and local AML/CFT landscapes, the current AML/CFT environment was reviewed to consider shifts in threats and vulnerabilities that have occurred since the conclusion of the 2020 Sectoral Money Laundering Risk Assessments.

The 2022 Risk Assessment covers 2020 to 2022 and builds on the findings of previously conducted risk assessments carried out by the Commission and the FIA. It demonstrates the Virgin Islands' continued commitment to identifying, assessing, and mitigating money laundering (ML) risk in keeping with the Financial Action Task Force's requirements.

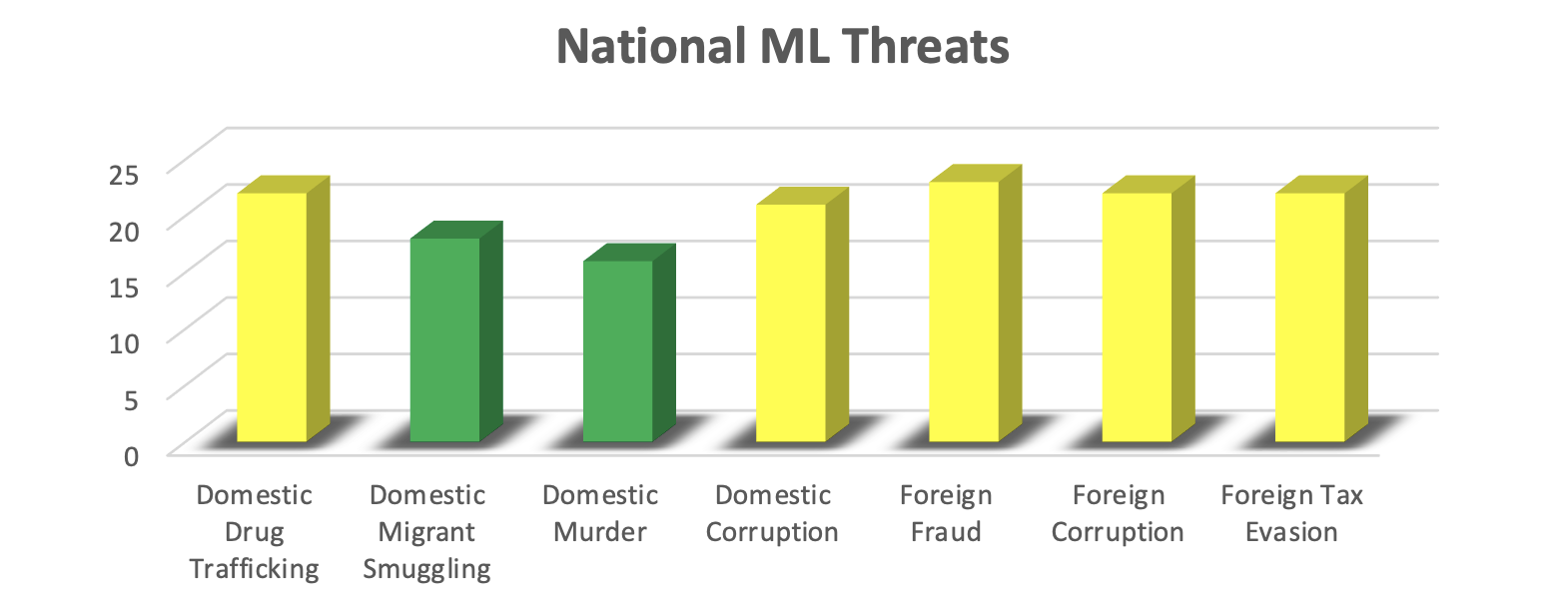

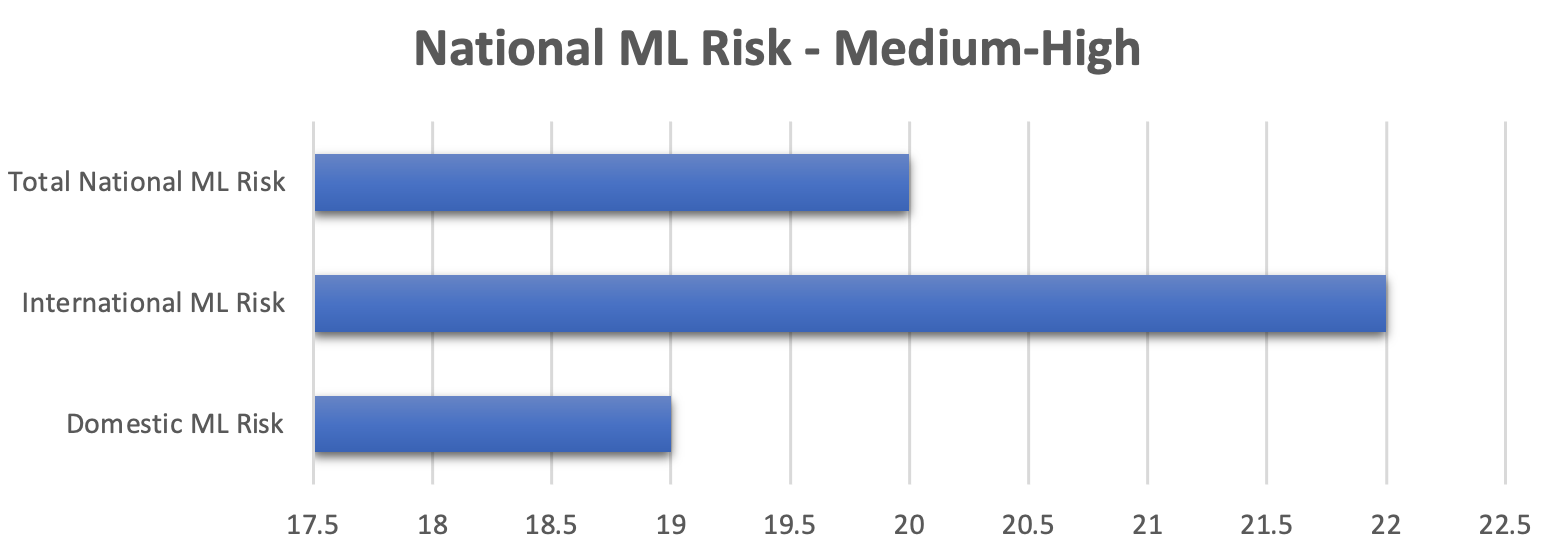

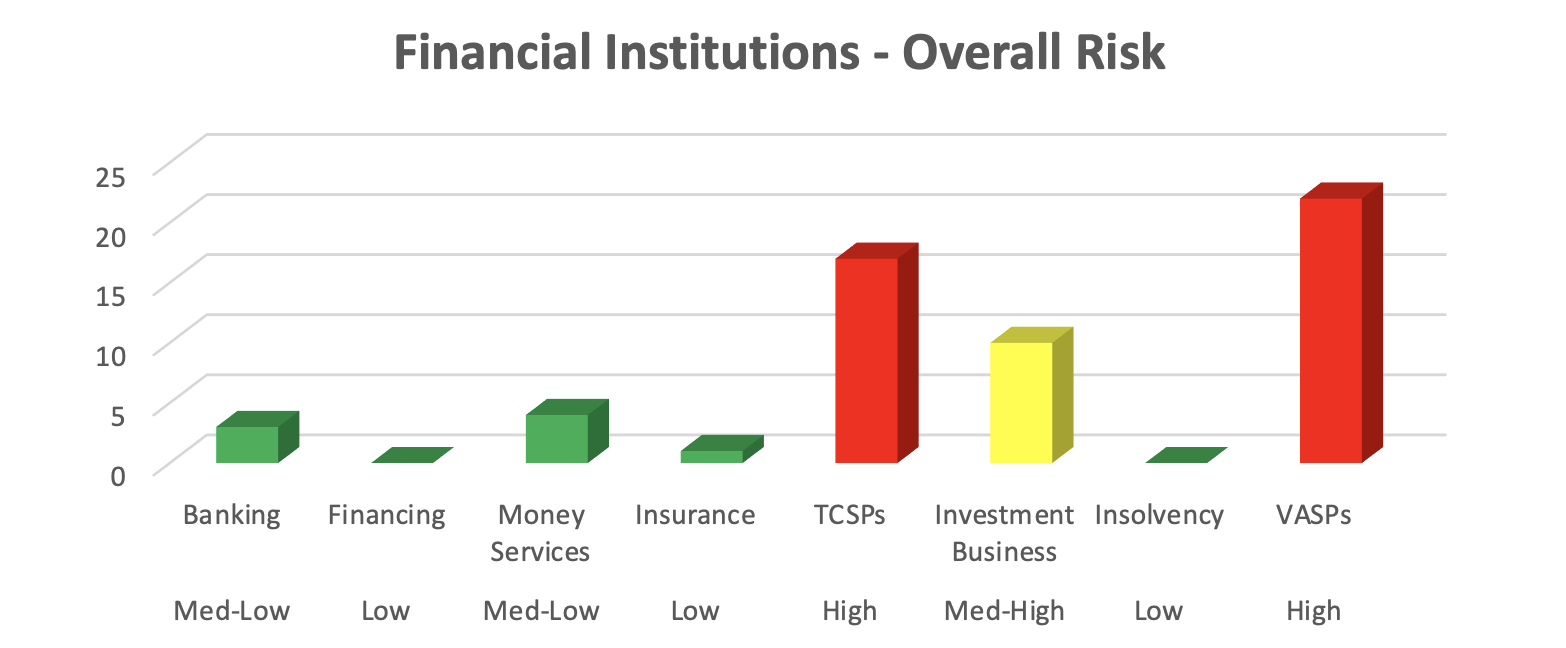

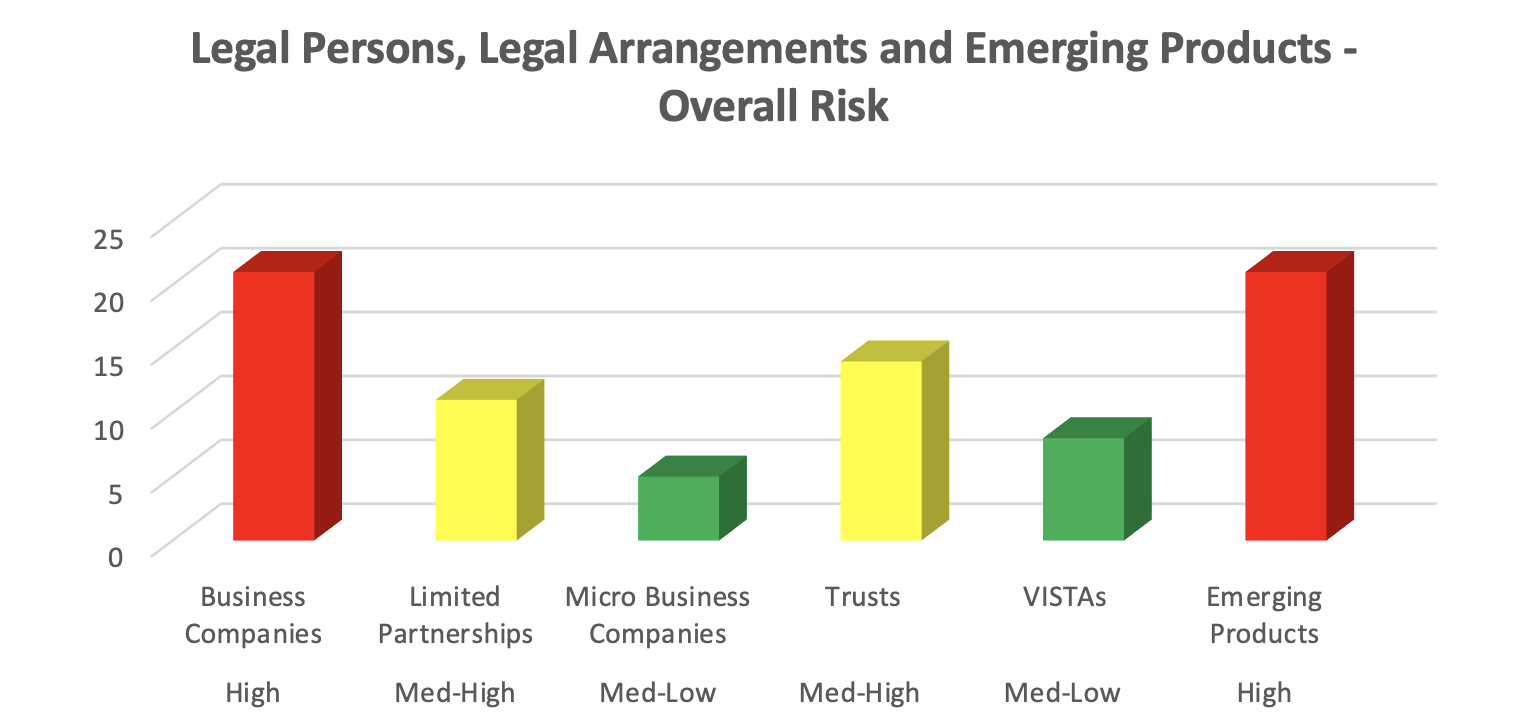

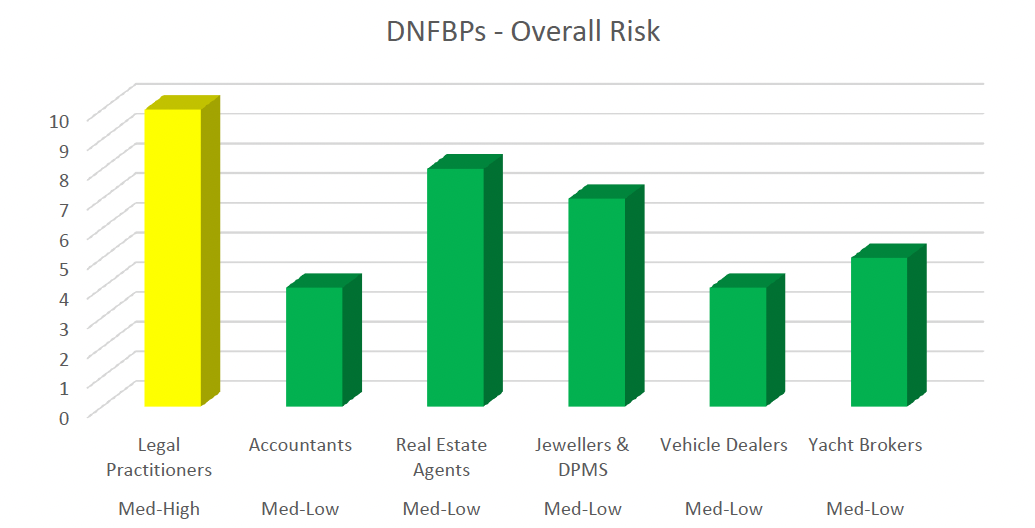

The 2022 Risk Assessment focuses on identifying and analysing the Virgin Islands' domestic and international ML threats and vulnerabilities at a national level and those ML risks within the financial services and Designated Non-Financial Businesses and Professions (DNFBP) sectors.

The following are snapshots of the results of the 2022 Risk Assessment:

Identifying and understanding these national and sectoral risks is critical to the Territory's efforts to ensure it can effectively promote and secure legitimate business activity while deterring persons from illicit activities for ML purposes in and from within the Virgin Islands.

As such, the Commission will begin its outreach by hosting a webinar in July to present the findings of the 2022 Risk Assessment to stakeholders. This webinar will ensure that each sector is aware of its specific risks.

In addition, we encourage licensed entities to use the information in the 2022 Risk Assessment Report when carrying out their risk assessments to help identify their ML risks. Likewise, the findings must form part of licensed entities' risk assessment of clients. The Commission will utilise its desk-based and onsite supervision mechanisms to test compliance and ensure these are appropriately incorporated.

The full 2022 Risk Assessment Report is available here on the Commission's website.

FSC INSIGHTS

BVI FSC MD/CEO Participated in the FSB Regional Consultative Group (RCB) of The Americas Meeting: To Serve a Two-Year Term as a Non-FSB Member Co-Chair

Effective 1st July 2023, Managing Director/Chief Executive Officer of the BVI Financial Services Commission, Mr. Kenneth Baker, will serve a two-year term as non-Financial Stability Board (FSB) member Co-Chair for the Regional Consultative Group (RCG) Americas.

Mr. Baker's appointment was announced in a meeting held in May this year in Toronto, Canada. He replaces Ms. Cindy Scotland, Managing Director of the Cayman Islands Monetary Authority, whose co-chair term ends on 30 June 2023.

Mr. Baker will share the co-chair role alongside another FSB member (who is yet to be determined); the co-chairs will be responsible for convening, organising and conducting the meetings of the RCG.

The work of the RCG established by the FSB is to bring together financial sector authorities from FSB member and non-member jurisdictions to exchange views on vulnerabilities affecting global economic systems and current and potential initiatives to promote financial stability.

More specifically, as stated in Article 20 of the FSB Charter, the RCG will provide a structured mechanism for:

- 'the interaction of FSB members with FSB non-members regarding the various FSB initiatives underway and planned;

- promoting implementation within the region of international financial policy initiatives; and

- the RCG members to share amongst themselves and with the FSB their views on vulnerabilities affecting the financial system, on FSB initiatives and on other measures that could be taken to promote financial stability.'

Mr. Baker, accepting his appointment, stated that he was "excited to take on the role of non-FSB member Co-Chair for the Regional Consultative Group (RCG) Americas, as it will allow non-member jurisdictions such as the Virgin Islands to continue to have input in the advancement of regulatory and supervisory methods being refined by the Financial Stability Board."

The RCG for the Americas is comprised of heads of financial authorities from Argentina, Bahamas, Barbados, Bermuda, Bolivia, Brazil, British Virgin Islands, Canada, Cayman Islands, Chile, Colombia, Costa Rica, Guatemala, Jamaica, Mexico, Panama, Paraguay, Peru, Uruguay and the United States.

See a copy of the recent FSB Americas Group Discussion press release here. For further information on the FSB, visit the website at www.fsb.org.

BVI Delegation Attends CFATF 56th Plenary Meeting

A delegation of officers from the Commission and the BVI Financial Investigations Agency attended the recent CFATF 56th Plenary and Working Group Meetings in Port of Spain, Trinidad and Tobago, 28 May 2023 – 01 June 2023.

The six-member delegation headed by Deputy Managing Director of Regulation, Mr. Glenford Malone, included the Commission's Deputy Director Policy, Ms. Allene Gumbs, Deputy Director AML/CFT, Ms. Alva McCall and Deputy Director External Relations, Mrs. Rhonda Hodge-Smith along with FIA Director, Mr. Errol George, and Deputy Director, Supervision and Enforcement, Mr. Dwyane Thomas.

The Cayman Islands currently serves as Chair of the CFATF, and Plenary meetings were presided over by Honourable Samuel Bulgin, KC, JP, Attorney General of the Cayman Islands. Mr. Malone, who currently serves as Co-Chair of the CFATF's International Cooperation Review Group, presided over the deliberations of that working group.

The CFATF 56th Plenary approved the Commonwealth of Dominica's Fourth Round Mutual Evaluation Report. Over the course of the Plenary and Working Group Meetings, issues discussed included AML/CFT compliance of VASPs, beneficial ownership requirements (for example, under revised FATF Recommendations 24 and 25), Fifth Round Mutual Evaluation Processes, and AML/CFT implications of cannabis legislative changes in the region.

Mr. Malone, as Head of the delegation, commented that "as a team, our participation in these meetings and group discussions is important for the strengthening our AML/CFT regimes and our ability to combat Terrorist Financing activities. Participation in these meetings is even more vital for the Territory as it undergoes its Fourth Round Mutual Evaluation Process."

Registry's Corner

Updates and important notices concerning the BVI Business Companies Act (the 'Act'), Amendments which came into force on 01 January 2023.

Registered Agents are asked to be aware of the following notices and requirements:

Bearer Share Companies

The industry is reminded of the changes that will go into effect on 1st July 2023, which relate to bearer shares and bearer share companies. These changes are outlined in Schedule 2, Part 2, Division 5 of the Transitional Provisions to the BVI Business Companies Act, 2004 (as amended).

Temporary Procedure for Restoring Dissolved BVI Companies via General Filings Function

To expedite the restoration process, when utilising the General Filing Function to facilitate the processing of applications for restorations, all legal practitioners and non-agents are advised to send an email to authorise the deduction of restoration fees and any outstanding fees and penalties from their debit account. Note that this is a temporary process; such emails will not be needed when this feature is transferred to the specific function.

Notifications to the Registrar to Reject Transactions

When requests are sent to the Registry outside of working hours for submitted transactions that are to be rejected, such requests should be sent ahead to the following email addresses to minimise the risk of the transactions being invalidly approved: support@bvifsc.vg and corporateregistrars@bvifsc.vg.

Please contact the Registry of Corporate Affairs with any questions concerning the above message at support@bvifsc.vg.

Legislative Summary

Anti-Money Laundering and Terrorist Financing (Amendment) Code of Practice, 2023

The Anti-Money Laundering and Terrorist Financing (Amendment) Code of Practice, 2023 (the ‘Code’) was issued by the BVI Financial Services Commission (the ‘Commission’) using powers given under section 27(1) of the Proceeds of Criminal Conduct Act (Revised 2020). The Code took effect on 17 March 2023 and aligns with international standards on AML/CFT.

The Code has been expanded to include persons (whether an entity or professional) acting as a trustee in the Virgin Islands with respect to carrying out customer due diligence measures (CDD) in accordance with section 28A of the Code.

The significant amendments to the Code are outlined below:

- Requirements to Undertake Customer Due Diligence

In line with provisions of the Code, all entities and professionals must undertake CDD (a process explained in section 19(3) of the Code) when entering into new business relationships, engaging in recurrent business relations with clients, as well as executing one-off client transactions. The requirement to conduct CDD stands irrespective of the nature or form of business being undertaken.

The Code was amended to refine the circumstances in which an entity or a professional must undertake CDD, as summarised below:

- When establishing a business relationship;

- When effecting a one-off transaction or several linked transactions involving $15,000 or more;

- When effecting a one-off transaction involving virtual assets valued at $1,000 or more;

- When effecting a one-off wire transaction involving funds of $1,000 or more, whether carried out as a single operation or part of several linked operations;

- Where an entity or a professional licensed or registered under the Virgin Islands Gaming and Betting Control Act 2020 affects a one-off transaction valued at $3,000 or more (or the equivalent in another currency), whether carried out as a single operation or part of several linked operations;

- Where the entity or professional suspects the business or customer (regardless of Code exemptions or low-risk status as identified by the entity or professional) of ML, TF, or proliferation financing (PF);

- Where a business relationship or transaction presents a specific higher risk scenario; or,

- Where the entity doubts the veracity or adequacy of the customer’s identification data.

If, after having regard to risk assessments conducted by a competent authority, law enforcement agency or other Virgin Islands authority with responsibility for ML, TF, PF, the business or customer in (f) above is identified as having lower risk, the entity or professional is permitted by the Code to simplify its CDD measures.

- Identity Verification

In the previous formulation of the Code, entities and professionals were permitted to complete identity verification within a reasonable time, not exceeding 30 days, after the business relationship was established. The amended Code removes this timeline, now permitting entities or professionals to ensure that verification is completed within a reasonably practicable time. This flexibility is only available where entities and professionals deem that it is necessary to invoke the provision to avoid disrupting the normal course of business.

The requirements remain for the entities and professionals to adopt appropriate risk management processes and procedures prior to establishing a business relationship and to properly monitor and manage the ML, TF, and PF risks thereafter. - Verification of Legal Persons

Enhancing the previous requirement to obtain information about legal persons for the purpose of identification and verification, the amended Code makes it abundantly clear that entities and professionals are to obtain documentary proof that the legal person exists and details of how it is legally structured. They must also verify the identity of directors (by whatever name) with responsibility for managing the legal person; identify the beneficial owner and persons purporting to act on behalf of the legal person; and understand the nature, ownership, and control structure of the legal person. - CDD for Nominators and Trustees

In expanding the measures for effecting CDD, the Code now calls for the disclosure of nominators and other persons. Nominators are identified as entities or professionals that provide or arrange for others to provide director or nominee shareholder services. Entities or professionals that act as directors of a legal person and, in so doing, accept instructions from others in relation to such service must disclose to the relevant legal person the identity of the person on whose instructions they are acting. Similarly, where an entity or a professional acts as a nominee shareholder of a legal person, it must inform the legal person of this fact and disclose information identifying the nominator on whose behalf they act in line with Section 25A of the Code.

In addition, under the Code, trustees acting on behalf of a trust must now disclose this status to the relevant entity or professional when establishing a business relationship or conducting one-off transactions on behalf of the trust for which they act.

Trustees are required to obtain accurate information and retain updated versions of identifying and other information on:

-

Beneficial owners of the trust being represented; and,

-

Any regulated agent of and service provider to the trust, such as an investment advisor, manager, accountant, or tax advisor.

The above information must be maintained for a minimum of 5 years after the entity or professional’s involvement with the trust ceases, failing which, an offence liable on summary conviction to a fine or imprisonment will have been committed.

- Outsourcing AML Functions

The outsourcing of AML functions is made possible by section 46 of the Code. Outsourcing, however, is conditional to a number of factors which are outlined in section 46(1).

In the latest Code amendment, the Commission moves away from carving out jurisdictions deemed acceptable for entities and professionals to enter business relationships with by virtue of their compliance with FATF Recommendations and the sufficiency of their AML and TF laws.

The amendment now provides for entities and professionals to adhere to the outsourcing condition of utilizing persons who are:

- qualified and competent to carry out the outsourced function; and

- resident in the Virgin Islands or a jurisdiction not classified by the entity or professional as a high-risk country and which could not pose a higher risk based on the risk assessment of the professional or entity.

- AML Obligations of Financial Groups

The new amendments to section 53A(1)(c) enhance independent audit and AML/CFT functions of financial groups by requiring group policies and procedures to include information and analysis on transactions or activities which, if analysed, would be flagged as unusual. The Code further allows for cross-branch and subsidiary information sharing (where appropriate) for management of ML, TF, and PF risk. - Money Services Business and Agents

Where an entity or a professional conducts money services business through agents, they must include such agents in their AML/CFT compliance programme and monitor the agent accordingly.

IMPORTANT NOTE: This summary should be read in conjunction with the substantive legislation, a copy of which can be downloaded from the Commission's website

BVI FSC's New External Relations Unit Launched

The Board of Commissioners, along with the Executive Team at the Commission, in line with the Commission’s 2022 - 2024 strategic objectives, which calls for a reconstruction of the frequency, modes, and priority placed on communication with industry partners and other audiences, has launched an External Relations Unit.

External Relations operates under the Policy Development and External Relations Division and absorbs what was previously known as Corporate Communications, consolidating three main Commission functions:

- Communications;

- Media Monitoring; and

- Financial Education.

Read more here.

Did You Know?

Did you know you can access the following Guidance documents on the Commission's Website?

2023 Trust and Corporate Services Providers Guide to Prevention of Money Laundering, Terrorist Financing and Proliferation Financing

These guidelines buttress the provisions for compliance with the Anti-Money Laundering Terrorist Financing Code of Practice (AMLTFCOP), the Anti-Money Laundering Regulations (AML Regulations), the Regulatory Code ('the RC') and the Financial Services Commission Act ('the FSC Act') and are geared towards assisting TCSPs in implementing a risk-based approach when applying measures to mitigate against money laundering (ML), terrorist financing (TF) and proliferation financing (PF) risks. Primarily relevant is using the guidelines to ensure TCSPs identify and verify all legal persons, legal arrangements, beneficial owners, and controllers.

2023 Virtual Assets Service Providers (VASP) Guide to the Prevention of Money Laundering, Terrorist Financing and Proliferation Financing

VASPs face unique risks from bad actors who may seek to use them for ML, TF and PF. These Guidelines have been developed to increase awareness of these and other risks, such as sanctions evasion, illicit financing activities and other financial crimes. Further guidance is provided regarding VASPs undertaking CDD and other related measures, including those on legal persons, legal arrangements, beneficial owners and controllers.